Expect the Unexpected

Back in 2008, I was riding in the passenger seat of my dad’s car in Rosenberg, TX, while my dad drove us. I think he was picking me up from swim practice, but my memory fails me at this point. And for the record, yes, I was 17 (almost 18), but I didn’t have my license yet because it was my first year living in the United States since 2000. Anyway, my dad had been emphasizing the importance of not speeding, allowing plenty of space between you and the car in front of you, and wearing a seatbelt - Ha! Well, we drove over a small bridge, which had an incline followed by decline. Sure enough, one who enforces the law (the commoners would refer to him as a “police officer”) was waiting on the other side, and was more than happy to observe that my dad was driving about 6 mph over the speed limit (41 in a 35, if memory serves me well), so he pulled us over.

Side note: it’s possible that this interaction at 17 years old further established my budding libertarianism; after all, my dad did nothing wrong.

After my dad was given a ticket, he was able to get rid of it by taking a defensive driving course — a “negotiation,” if you will. I would like to reinforce that it was moments earlier that my dad was giving me tips on how to be a good driver, and how to avoid getting into situations exactly like this. It took him probably just a few days to complete the online course, and at its end, he actually did have one important takeaway, and while I thought it was common sense, I have found myself referring to his takeaway again and again over the years: Expect the unexpected. This means that, while driving, you should assume that things will not go as you think they will. When the light is red at an intersection, you should assume that a teenager fell asleep at the light, or that a millennial is about to plow through because he was at the bar too long. Or perhaps you are driving down the highway — your assumption should not be that everything will be fine, and that it’s just you and the open road. That’s a romantic view of life, but it is not realistic. You should expect that the car 50 yards ahead, in the lane to your right, going 10 mph slower than you, is about to swerve into your lane because she is in the middle of watching Tik-Tok, or that the graveyard shift employee to your left is falling asleep. When you see brake lights in front of you, you shouldn’t see how close you can get to that bumper in front of you; you should leave plenty of room for them to do whatever it is they are going to do. All of this, of course, assumes a certain degree of rationality, which translates into not wanting to get into an accident.

I finished a book last week called, Thinking in Bets by Annie Duke. It’s written by a professional poker player who eventually took what she learned playing and turned it into a profession in consulting on statistics and decision making. One quote that I really liked from that book is applicable to this idea of always being ready:

“What good poker players and good decision makers have in common is their comfort with their world being an uncertain and unpredictable place.”

This idea of expecting the unexpected is critical to investing, particularly in 2022. Value investors look at a Price to Earnings ratio of 8 and say, wow, this is great value. And it’s not some tech stock without assets, it’s a heavy manufacturing company, so a ratio of 8 is cheap, relative to the historical norm. Does that mean you should go all-in? Should you even by? What if the market would like to see the P/E ratio drop to 3 first, or even 2? And what if that takes a year and a half to play out? This is more or less the concept of a falling knife, and that’s why context matters. And even if all the fundamentals point to you being right, it’s also critical to remember that,

“markets can remain irrational a lot longer than you and I can remain solvent”

- A. Gary Shilling

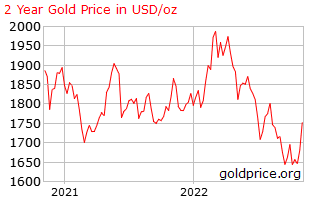

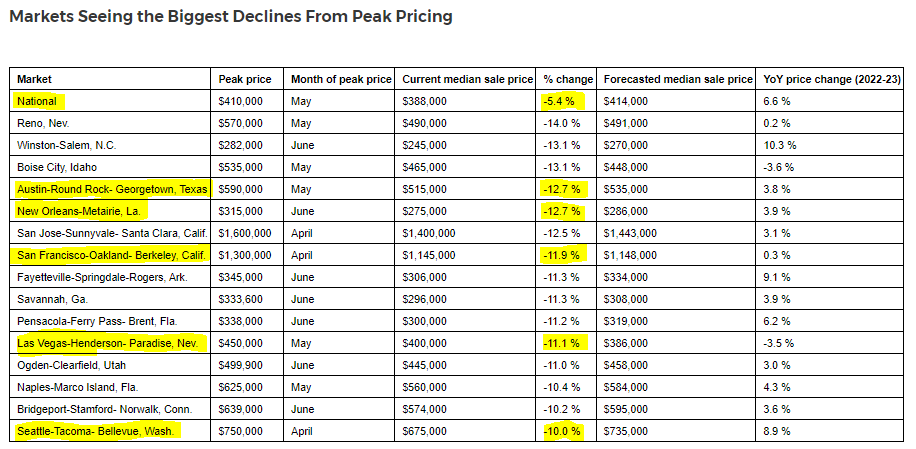

What about gold bugs? What about bitcoin maximalists or ‘hodlers’? After all, we are in the worst inflationary period in decades. Well, here’s a friendly reminder of how each of these asset classes have done in the last two years:

Okay, well the stock market is full of risks — it’s a casino! And gold bugs are old — they should be dead! And ‘bitcoiners,’ well, they’re lazy kids that are just looking to get rich quick. It’s all about real estate! Right?

The point isn’t to marvel at all the declining prices. And the point isn’t to tell you to stay away from touching any kind of asset class. The point is to be cautious about your “sure thing” idea that is touted by the talking heads and the “respectable” class.

In the end, there is one adage that is attributed to the British military, but I learned it, or a variation of it, from Doug Casey:

The Seven Ps

Proper planning and preparation prevents piss-poor performance.

Remember: Expect the unexpected!

Regards,

John